After diligently logging every single expense over the past year, I thought it would be worthwhile to get a snapshot of my personal finances during this time. In this postmortem, I’ll be analyzing my budgeting and expenses – seeing how much it actually costs for a McMaster University student living away from home in Canada/Ontario/Hamilton.

This was an excellent personal finance exercise for me – I would highly recommend running through something similar if you really wanted to understand and improve upon your financial well-being.

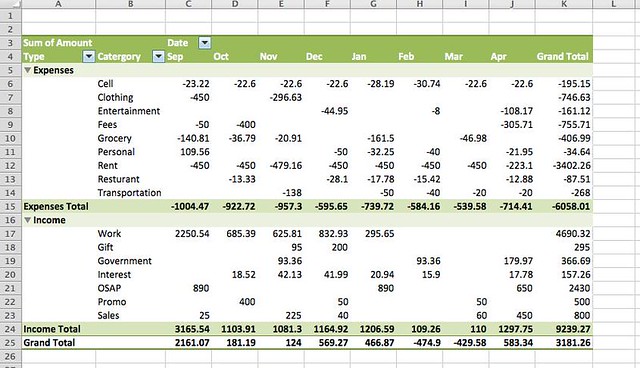

This is a simple pivot table I created from logging a grand total of 139 lines of transactions throughout the year. If you think about it, its actually not a whole lot! (As it also includes income) It equates to around 18 transactions a month.

Before we dive in, I need to lay out some key assumptions for the analyses:

Before we dive in, I need to lay out some key assumptions for the analyses:

- I won’t be able to calculate a lot of the commonly used personal finance metrics like liquidity ratios, savings ratio, service ratio, debt/income, etc. because I don’t have a steady job and have a huge tuition burden, essentially my expenses>income. My net worth is also in the negatives as I carry a huge student load courtesy of Canada gov’t. If you are a working individual and somehow manage to get yourself into this situation, seek help immediately. Its highly unusual and dangerous to be in negative cash flow, unless one is paying down debt/mortgage.

- I didn’t include my tuition ($6900) into any of the calculations, except for the pie chart. Its a single, huge outlay that accounts for over half my total expenses throughout the year, which really screws everything out of balance.

- My “fiscal year” runs Sept – Apr, which isn’t really a full year (8 months), but it makes the most organizational sense to categorize based on academic year – to see how much it costs living as a students. Summers are highly variable, between jobs and travelling, the analyses wouldn’t make much sense.

- The focus will be on expenses rather than my income, which is highly variable and quite odd (i.e. Kijiji sales, bank/CC promos, pt time job, experiments, etc.)

At a Glance:

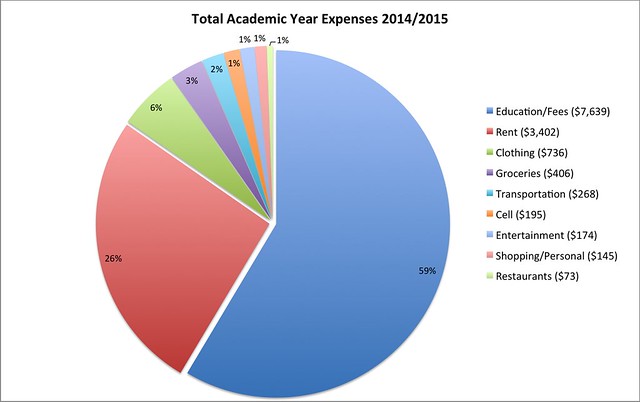

This pie chart summarizes my expenses quite well –> in total including tuition, I spend around $13,000 per academic year. Not bad! Starting out, I had projected a total cost of $15,000, which I though was extremely conservative. Glad to see I exceeded expectation.

- Apart from tuition (which I have to pay), rent is my next biggest expense at 24% of total expense.

- Because it takes up such a huge piece of the pie, so to speak, I should really be hunting for the cheapest/best bargain rental to make the biggest change in my expense.

- Even though I’m not looking at income, a common benchmark for Canadians is to aim for housing expenses <30% of take-home income.

- Clothing comes in at a far 3rd place, 6% of total expenses. It’s quite high for someone as frugal as myself. But realize cheap =/= frugal. I still strive to get the best bang for my buck, and I only purchased 2 items all year that really accounts for it! A Nobis Cartel at $440 (retail $1000) and Margielas at $225 (retail $600).

- Groceries is something special here… Averaging it out, its around $50/month! What’s even more impressive is, that amount also includes my supplements! I bought 4 tubs of whey throughout the year (2 Kaizen and 2 Optimum). Again, I was lucky enough to buy them at a steep discount. Without supplements, that is $25/month!!!

- FYI, 3% of EXPENSE were groceries, while the average Canadian spends 10% of INCOME, which would be >10% of EXPENSE on groceries.

- The rest is basically negligible.

- Transportation – I only travel via rideshares or GO bus, which really brings down costs. To compare, a one way trip home for me (Hamilton – Ottawa) costs $40 rideshare, vs. $80 greyhound and $100 VIArail.

- Cell – I’m on Fido’s retention plan after threatening to quit several times. It’s $22/month for unlimited text and 50 Canada-wide minutes. It’s actually not the greatest plan, I can get double the minutes at the same price with Petro Canada Mobility or 7/11 Speakout, which I’m planning to switching to this summer.

- Entertainment – Refraining from buying drinks at bars/clubs, its actually not very expensive for a night out. Cover is typically $5 – 20, which is more than enough for a few outings each month.

- Shopping/Personal – The bulk of it was my gym membership, 8 months for $160 at school.

- Restaurant – Averages out to eating out 1x month or less. But seeing all the free food I get, I’m basically eating out several days each week. I’m enjoying delicious meals prepared by others, with good company, that I don’t have to clean up after = eating out.

Monthly Trends:

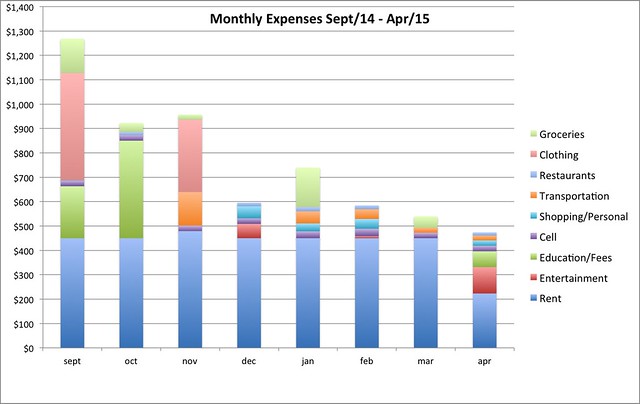

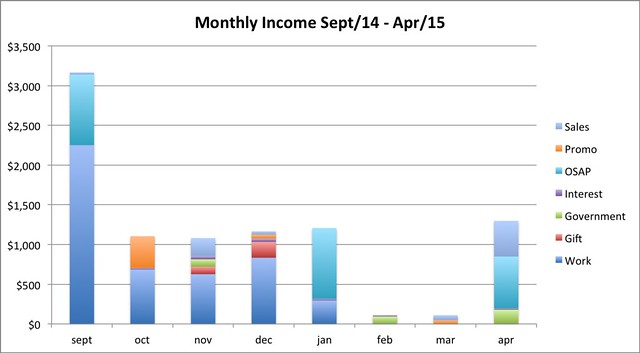

Looking at this chart can give you some interesting insight into my life and lifestyle, or so I hope.

- Rent accounts for over half my expenses each month – it really strikes home how cutting down your biggest expenses will make the biggest impact (…well obviously)

- Expenses are highest at the start of each semester, sept and jan, because I need to stock up for the year. They generally taper down as the months go on as I’m living off my stockpile. “Stockpile” refers to groceries, hygiene, consumable goods, etc.

- Entertainments costs are highest at the end of the semesters, dec and apr, which makes sense as to not compromise my academics.

- My income is quite unstable – by working part time from Sept – Dec really helped a lot with my expenses

- I made around $4,600 from working part time

- Government bursaries like OSAP and McMaster Bursaries totals up to $2,430. This is literally free money I don’t have to pay back. Takes a total of 15min of clicking a webpage. Every single student should be applying for this – its guaranteed money. But I’ve met some students reluctant to apply and yet complain about money problems… talk about hypocrisy and ignorance!

- I have miscellaneous income from selling clothes and furniture on Kijiji, which totals up to an impressive $800. I’ll probably write a post detailing my Kijiji experiences and lessons learned in a near future.

- Bank and CC promos usually start in the summertime – in this case, I applied for the CIBC $400 promo which didn’t payout till October. It’s rare to get straight-up cash from them; usually they offer travel points or electronics as sign-up bonus, which are still valued anywhere $100 – 500.

- I parked several thousand dollars in a 2.5% interest account with Tangerine, which is not bad given current interest rates and its a good emergency fund to have.

- Note, everyone should be building a 3 – 6 month safety fund. It would suck to have to use a CC in an emergency and pay that back at 20+% interest.

Takeaways:

- Costed me $13,000 all in, including tuition to study in Hamilton, ON as an undergrad for 8 months.

- Tuition was around $7,000 so $6,000 was living expenses for 8 months.

- $2,400 was guarantee government bursaries

- Brings annual costs down to $10,5000

- Additional income I generated = $7,000

- Net costs of 8 months = -$3,500

The point I wanted to make here was, by working a part time job during the year, and working full time in the summer, its more than possible to graduate without debt, possibly even making money. I worked 1 shift/week and managed to maintain grades in the A range. During the summertime, even 4 months working a McDonalds can net you $5,000 easy. Some of my friends in banks managed to make around $20,0000 over 4 months! Basically its more than possible to graduate without debt, as long as you live frugally and not indulge in frivolous spending like lattes, fast food, drugs and alcohol.

Some of my habits:

- Throughout my 3 years in undergrad, I never bought fast food or coffee for myself – its ridiculously overpriced, especially on campus. I only eat out/ coffee dates with the company of others. For me, eating out has a huge social component; no point to eating $15 Chinese takeout by myself when $2 canned tuna and beans can suffice.

- Never bought new textbooks. First place I look is for online copies, if that fails, I borrow with friends. Failing that, I buy used or share textbook with classmates, which I then resell.

- In my 1st year, I spent around $150 on textbooks, all used. In my 2nd year, I spent $0 on textbooks (all online) and this year I spent around $50 for a shared online copy.

- It absolutely blows my mind when people budget $1,000 for textbooks a year. That’s called highway robbery. If you do buy new, reselling is a MUST to recoup the losses. Chances are, you will never open that book again.

- Sometimes professors like to snake students into buying $100 online quizzes. They will probably boost your mark 3% max but in my experience, it doesn’t make any difference. I’ve never bought into these scams and still came out the course with A+. You won’t buy better study habits, if you really need the practice, find online practice tests or work with some friends.

- Everything I buy is on sale or is a hot deal.

- I practice this with everything from food to clothing to travelling and etc. If its a hot deal, I’ll jump on it. It lets me indulge in otherwise expensive luxuries with less guilt, and I greatly increase the purchasing power of my money.

- When dealing with groceries, buy as much of it as possible and stock up for the future. You want to be living off the goods from the last sale to carry you into the next sale.

- The more you do this, the better you will be at detecting sales and understanding price points of common goods. i.e. dozen eggs at $2 is quite frequent at Shoppers, any meat under 1.99/lbs is a good price etc.

- Cut down on things you don’t need.

- Case and point: my cell phone bill is only $20/month. I use an iPhone but don’t have any data plan. I’m on campus most of the time, connected to wifi or I can hop in a coffee shop for free wifi. If I’m travelling and need internet, I’ll buy a 7 day pass for $10. I don’t need to check Facebook/Instagram for the 5 minutes I’m on a bus and unwilling to pay additional $30/month for this feature.

- My lifestyle is quite minimalist – other than buying consumables (food, personal hygiene, services, etc.) I don’t spend money buying a lot of physical items. It maximizes the usage I get from the few things I own. In short, reducing excessive clutter.

- If there’s every something I stop using, be it clothing, furniture, electronics, etc. it immediately goes on the Kijiji listing. I usually have no problem selling at a loss, simply because it’s useless for me and takes up space, so I’ll be glad someone else can find use for it.

- Don’t be wasteful.

- As a child, I was told to never waste stuff – after each meal, our plates would be quite literally, licked clean (ok, I’m exaggerating here, but you get the point). Similarly, leftover restaurant foods are always doggy-bagged. Heating and AC rarely ran as my sibling were told to “suck it up” and lights are always turned off. Clothes were always hang-dryed and the dryer itself hasn’t been turned on for months, and I can go on and on. We were a middle class family, but lived very conservatively.

- Granted, my parents may have overdid things to the point of inconvenience, but the basic principle is: live efficiently. Only buy or engage in things you will use fully and vice versa.

- It really kills me to see people throw away half eaten food or good food 1 day past expiry. Forecast properly next time and don’t buy so much.

- Take advantage of stuff

- Take advantage of hot deals – buy now, decide later: if you don’t like it, you can always return it.

- Take advantage of student services – apply for bursaries, ask for student discounts, visit food banks and go to those free food event!

- Take advantage of bank and CC promos, stop being suspicious of the wrongs things. If something is too good to be true, look it up.

- Buy everything with your CC – collect points, get free extended warranty, extended returns, insurance and various other benefits. Treat it like a debit card and simply pay it off every month.

- Rejection is better than regret.

- Don’t let ignorance and laziness get in the way of pleasure and rewards.