this just in – American Express Platinum

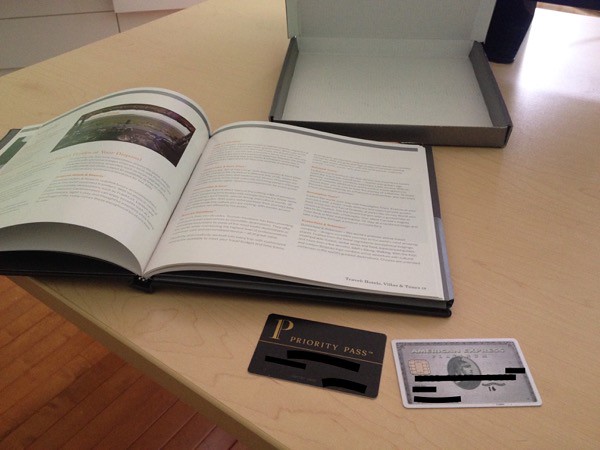

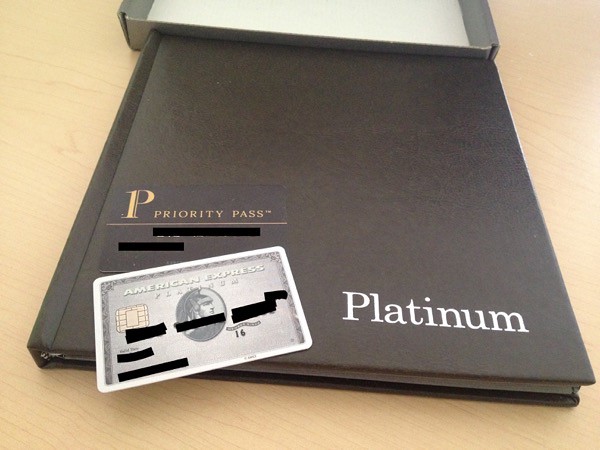

I applied for this card sometime last month (April 2016) and it came through a few weeks ago. For people unfamiliar, it’s one of the most elite credit cards offered in Canada. It also requires a minium income of $40k/year to qualify (more on this later). Check out the packaging it came in! It shipped with a leather bound book.

I was initially quite hesistant to apply for it, because of its $699 annual fee!

I’ll talk about the benefits and bonuses ($1549 + more) that came with the card, and how it outweighs the $699 annual fee.

Vraiment, I get no greater pleasure than whipping this bad boy out at the cash register to pay for my $20/month groceries 😉

For the past few years, I’ve been signing up for multiple credit cards each year to take advantage of their generous sign up bonuses. Example (CIBC $400)

Do I make 40k/year??

lol I’m still in school… As far as sign up bonuses go, American Express offers some of the most generous packages for new clients. I stated earlier they require a minimum $40k/year to even qualify. Remembering your credit score doesn’t have any information on your income level or net worth, so there is no way for them to verify. Fill what you want in the application form, within reason, and pray they don’t require you to fax in an income stub for proof (rarely happens). Clearly I’m not ceo10kday yet I still managed to land this card.

Another cool thing – this card is a “charge card” – that means there’s no limit on purchases. I can go out and buy a dozen ferraris if I feel it. Making the payments, however, is another question entirely. Because it’s a charge card, interest is 30% instead of 20% on normal credit cards, but obviously I’m paying off this card in full each month so this is a non-issue.

This is what I got in return for $699:

Sign-up bonus

75,000 amex points (valued at $750)

I convert these points 1:1 to aeroplan points for flights. For reference, 60,000 aeroplan/amex points is enough for a roundtrip flight from Canada to Western Europe

Card perks

Priority Pass Membership (valued at $399)

One of my favorite perks. It allows me +1 to use VIP airport lounges whenever I’m flying. Usually they’re reserved for business/first class passengers, or for customers willing to pay $30 or so per visit. These lounges are great. There’s always free alcohol and food on deck. Most lounges have a self serve buffet and unlimited premium alcohols/bar. Some lounges even have showers, spas and massage areas. Honestly, flying has never been more relaxing.

When I was flying Ryanair in europe, some plane tickets costed only $10CAD, from UK to EU cities! The food and alcohol I consumed at the lounges more than made up for the ticket itself. I seriously contemplated buying cheap tickets just to enter the airport and dine in the lounges.

My brother had this card last year, and I shared his priority pass membership to access lounges across Europe. Here’s some snapshots of my experiences.

$200 free travel credit per calendar year (valued at $400)

Each calendar year (jan – dec), you get to spend $200 for free by booking plane/hotel/car through American Express’ travel website.

However, the website prices are fairly expensive (marked up 15% usually) and I only fly with aeroplan points or mistake fares, and rarely book hotels.

There is a workaround for this stated by many people on other blogs – you book $200 worth of hotel at a place that offers free cancellations. Once the payment goes through and your bonus is posted on your CC statement, simply cancel by calling the hotel, and you should see $200 credited back to your account. -> I haven’t tried this yet, but most likely will before dec.

Travel Insurance

If you buy plane tickets with this card, and your flight is delayed for 4+ hours or your baggage is delayed for 6+ hours, you get $1000 to spend on hotels, food, sundries, clothing and other “essentials”

I haven’t been lucky enough to use it yet, but real talk everytime I fly I’m hoping for a flight delay to get some extra spending money.

Purchase Protection

Clothing, electronics, etc. any purchases made by this card also recieve double manufacturer’s warranty – basically if the camera you bought on the card breaks after 1.5 years, you can get it repaired and amex will reimburse you the cost.

Also, if you accidentally break/stolen your new purchase within 90 days, amex will cover that, under certain terms and conditions.

In my experience, and others, Amex is very generous and pleasant with their warranty and travel insurances. They don’t try to nickel and dime you like other CC providers so this is an excellent perk.

This is the reason why I put every purchase on my credit cards – cash and debit for spending are for suckers, as you lose out on alot of insurance and ability to collect points.

Elite Status at Hotels

With this card, you also get complimentary gold or platinum status at most luxury hotel chains worldwide, including Hilton, Fairmont, Radisson, Novotel and a bunch of other ones.

The elite status typically means complimentary room upgrades, early check in, late checkout, gift upon arrival, free breakfast, hotel lounge access and extra points earning.

As I’m not a business traveller, this has limited use for me, probably 2-3x/year max.

Amazing Customer Service

There’s a 24hr dedicated line for platinum card holders – no wait times and no bs with automated telephone lines. They can hook you up with a personal concierge, travel guides and generally any aide. The operaters on the other end speak in perfect english and I’m not having to dicipher international accents anymore.

There’s no direct cash value associated with the last 4 perks but it’s very valuable to have. There’s obviously a host of other perks, but these are the ones I use the most. Some others include

– VIP at Pearson airport, dedicated checkin, free valet parking etc.

– Travel medical, death, interruption insurance

– Getting concert tickets not available to public

Summary

- The most valuable part of this card is the one-time sign up bonus. Valued at $750, it more than makes up for the annual fee, so the rest of the perks are just gravy.

- Airport lounges are dope.

- $1000 comp if you plane/bags are delays

- Buying stuff is safer – free warranty and accidental damage

- again, never buy with cash/debit – you lose out on security, perks and rewards. If poor money mgmt is a problem, that’s a whole other issue.

- I’ll cancel this card after the year is up, to avoid paying another $699 fee, but in the meantime, catch me stunting on cashiers and sales associates.

- BTW, the website shows only 50k bonus points. In order to get the extra 25k you need to apply with a referral link. If you’re interested, drop your information in the Contact Tab and I’ll send one over.